Understanding french VAT in real estate: a comprehensive guide

Forts d’une expérience significative dans le domaine de la TVA immobilière et des droits de mutation, nos avocats interviennent quotidiennement dans la structuration de projets immobiliers d’envergure. L’engagement de construire est un mécanisme central dans la réalisation et le financement des projets.

The firm is recognized as having a « strong reputation » in VAT and real estate taxation.

Introduction to French VAT in Real Estate

What is french VAT?

Value-Added Tax (VAT) in France, particularly in the real estate sector, encompasses a broad array of regulations applied to transactions such as sales, leases, leasebacks, and even the division or lease of buildings under construction. Stemming from the significant reform of 2010, the current VAT rules on real estate are intricate and vary significantly depending on the nature of the property involved and the status of the parties in the transaction. At its core, French VAT aims to tax the value added at each stage of production and distribution, including the final consumption. This tax applies to most goods and services, including those related to real estate.

In the realm of real estate, the application of VAT is differentiated primarily based on whether a building is considered new or old. A new building is one that has been completed within the last five years, a timeline that begins, in principle, from the date of the Declaration of Completion and Compliance (DAACT) or an equivalent document. Conversely, buildings older than five years are classified as old. These distinctions are crucial as they determine VAT’s applicability to transactions involving real estate properties.

Importance of understanding french VAT in real estate

Navigating the VAT landscape is essential for anyone involved in the French real estate market, whether you’re a buyer, seller, investor, or professional advisor. Understanding these VAT regulations ensures compliance with tax obligations and helps in identifying potential tax advantages or exemptions. For instance, certain transactions involving old buildings can be exempt from VAT, while new constructions are typically subject to it. Knowledge of VAT applicability can significantly affect investment decisions, financial planning, and the overall costs associated with real estate transactions.

French VAT regulations in real estate

VAT rates and applicability in french real estate

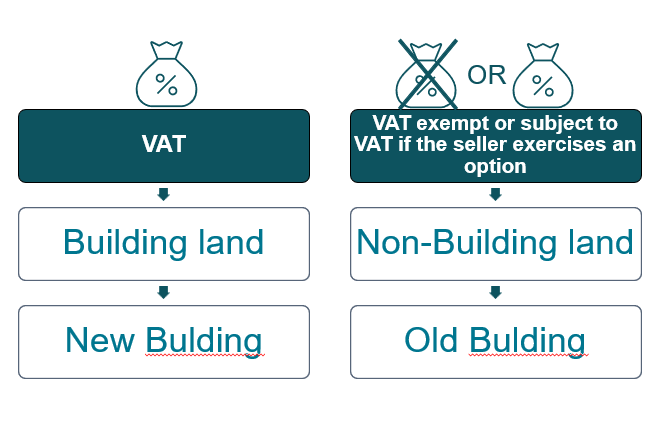

In French real estate, VAT rates and applicability hinge on several factors, including the property’s age, nature of the transaction, and the parties involved.

- New buildings, defined as those completed within the last five years and possibly including significantly renovated or elevated properties, are generally subject to a standard VAT rate of 20%. This rate applies regardless of whether the transaction is between professionals or involves a private individual actively marketing the property.

- Old buildings, or those completed more than five years ago, present a more nuanced VAT scenario. Transactions between private individuals (non-VAT subjects) involving these properties typically fall outside the scope of VAT. However, when a professional sells an old building, the transaction enters the VAT sphere but is often exempt, though options for taxation exist under certain conditions.

Additionally, the sale of building plots also features its unique VAT considerations, dependent on whether the transaction is between private individuals or involves professionals and the local urban planning regulations.

Procedures and compliance for french VAT in real estate

Adhering to VAT procedures and ensuring compliance in real estate transactions require a thorough understanding of the applicable regulations and the correct application of rates. It involves accurately determining the VAT status of properties, whether new or old, and applying the correct treatment for sales, leases, and other real estate operations. Compliance also entails proper documentation, such as the Declaration of Completion and Compliance for new buildings, and understanding the options for taxation and exemptions available under French law.

Best practices for dealing with French VAT in real estate

Strategies for managing french VAT in real estate transactions

Successfully navigating French VAT in real estate transactions requires a strategic approach, especially given the complexity of the tax’s applicability based on the property’s status and the nature of the transaction. Here are several strategies to consider:

- Determine the VAT status early: Identifying whether a property is considered new or old under VAT law is crucial. This classification impacts the tax treatment of the transaction and potential exemptions. For new properties, VAT typically applies, while for older properties, the applicability of VAT can vary. Understanding this from the outset can guide strategy and compliance.

- Leverage exemptions and options for taxation: There are specific conditions under which sellers can opt for a property transaction to be taxed or exempt from VAT. For instance, in transactions involving old buildings, opting for taxation can sometimes be beneficial if it allows for VAT deduction on renovation or construction costs. Carefully consider these options in the context of the overall tax planning strategy.

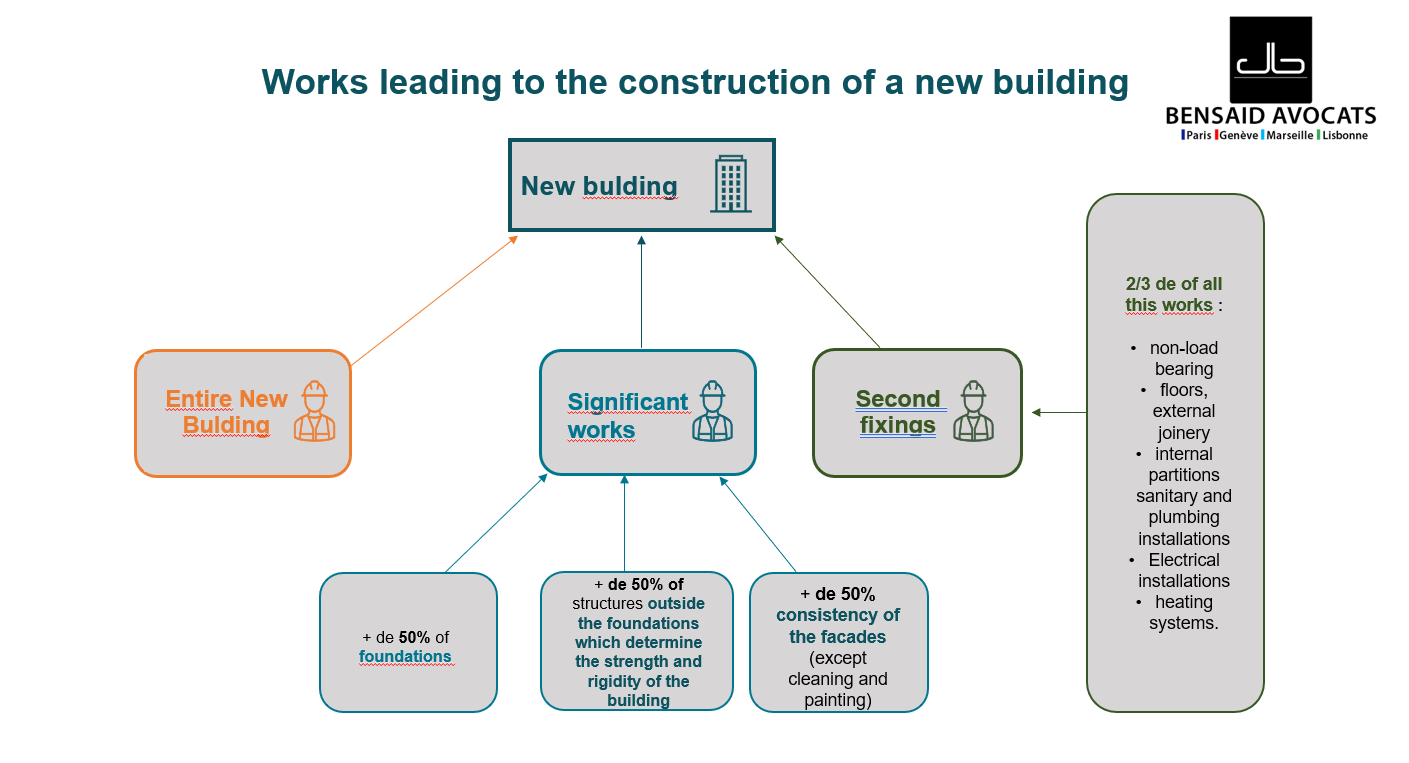

- Understand the impact of renovations: Significant renovations or additions can change a property’s VAT status from old to new, thereby affecting VAT applicability. Before undertaking any major work, evaluate how this might change the VAT treatment and what implications it has for a future sale or lease.

- Consider the timing of transactions: The VAT implications can also depend on the timing of the transaction, especially for new constructions. Planning transactions strategically around the five-year mark can influence VAT treatment, potentially offering tax advantages.

- Document compliance and Due Diligence: Maintain comprehensive records of all transactions, including contracts, VAT calculations, and compliance documents like the DAACT. Proper documentation is essential for audit readiness and can serve as evidence of compliance with VAT regulations.

Seeking Professional Assistance for French VAT Compliance

Given the complexities of VAT in real estate transactions, seeking professional advice is often the best course of action. Tax professionals or real estate lawyers specializing in French VAT can provide:

- Expert guidance: Professionals can navigate the intricate details of VAT legislation, ensuring compliance and optimizing tax treatment for each unique situation.

- Strategic planning: Expert advisors can help plan transactions to take advantage of tax benefits, exemptions, and options for taxation, aligned with broader financial or investment strategies.

- Compliance and documentation support: Professionals can assist in preparing and reviewing all necessary documentation for VAT compliance, reducing the risk of errors or non-compliance.

- Updates on legislation: Tax laws and regulations can change. Professional advisors stay updated on these changes, ensuring that strategies and compliance measures remain current and effective.

In summary, while managing VAT in French real estate can be complex, employing strategic approaches and seeking professional assistance can greatly simplify compliance, optimize tax treatment, and ultimately contribute to the success of real estate transactions.

« The firm has developed a significant practice in supporting large-scale real estate projects and resolving complex real estate tax issues. »

01.

Real estate tax Law

Nous intervenons sur l’ensemble des problématiques relatives au domaine immobilier, en accordant une attention particulière aux questions complexes qui requièrent une expertise approfondie.

02.

Trust

Le Cabinet a développé une pratique significative et singulière dans les opérations de fiducies et de financements complexes. Cet accompagnement financier permet une structuration complète des projets envisagés, notamment en matière immobilière.

03.

VAT

Nos avocats offrent non seulement une expertise TVA en matière de conformité fiscale et de stratégies d’optimisation fiscale, mais aussi une assistance précieuse en cas de litige.

Paris

49 Rue de Courcelles

75008 Paris

TÉL:

FAX:

Marseille

Villa Notre Dame

25 Boulevard Notre Dame

13006 Marseille

TÉL:

Cannes

3, rue du Maréchal Foch

06400 Cannes

Genève

Rue du Général Dufour 22

1204 Genève

Lisbonne

110, Avenida de la Liberdade

1250-096, Lisbonne

BENSAID Avocats

Société d’Avocats au capital de 150 000 €

Tous droits réservés